Released on

A program mostly used by small employers will see some popular temporary changes go permanent thanks to a new Washington bill.

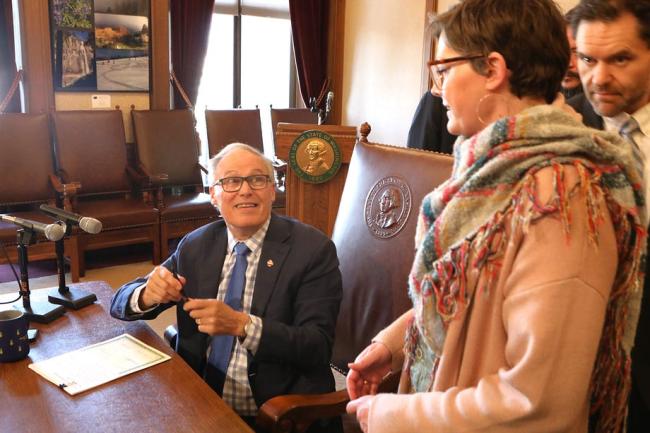

House Bill 1901, signed into law March 13 by Gov. Jay Inslee, makes permanent some pandemic-era modifications to Employment Security Department’s Voluntary Contributions Program.

Adopted in 1995, the program allows employers to reimburse the Employment Security Department (ESD) for benefits paid up front in exchange for subtracting those benefit charges from the employer’s account. Doing so reduces the employer’s experience tax.

Few employers made use of the program until 2021, when the Legislature adopted Engrossed Substitution Senate Bill 5061. This new bill made the program more accessible by:

• Removing the 10% surcharge requirement.

• Opening the program up to employers that have moved eight, rather than 12, rate classes.

• Allowing employers to buy down enough benefit charges to move down at least two, rather than four classes.

• Extending the deadline to apply for voluntary contributions from Feb. 15 to March 31 each year.

These changes were set to expire on May 31, 2026. But House Bill 1901 made them permanent for employers.

History and participation trends

Between 2010 and 2020, the Voluntary Contribution Program averaged about nine participants per year. Since the expansion of the program in 2021, about 62 employers have participated each year.

While the impact of the pandemic resulted in a notably higher uptake in the program in 2021 and 2022, the 2023 numbers suggest a continued interest in these provisions.

Since the program modifications went into effect in 2021, usage has been highest among small businesses. Businesses with less than $250,000 in annual taxable wages account for more than 75% of participating employers.

Which employers benefit from the Voluntary Contributions Program

Program costs and benefits are unique to each employer. In general, the Voluntary Contribution Program may help an employer if they:

• Anticipate taxable payroll will grow or be stable over the next four years.

It may not help if an employer:

• Anticipates another large spike in benefit charges.

• Expects a large drop in taxable payroll.

• Thinks they will close their business in the next four years.

The program can be valuable for many employers but doesn’t make sense in every scenario. Check out ESD’s Voluntary Contributions Program page for examples that show how the program can affect employers in different circumstances.

To view more photos from the signing, visit Employment Security Department’s Flickr webpage.